You will need to identify and appoint your principal adviser. Therefore you will need to appoint a legal advisor Lawyer and a financial advisor to.

Oped The Net Benefits Of Neutrality Debates Continues Debate Net Neutrality Live News

Select an investment bank.

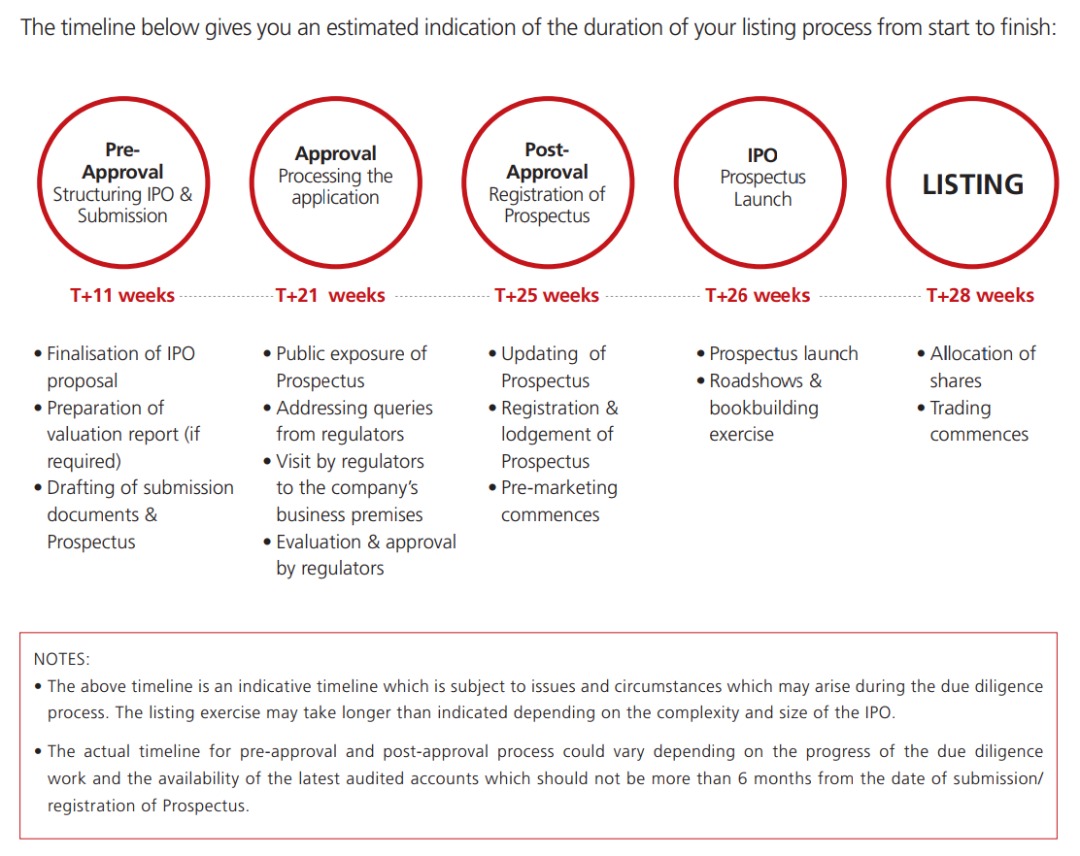

. Generally an IPO will take around 30 weeks to complete following the appointment of the financial advisors and there are 2 major workstreams namely legal and marketing. Typical IPO Process and Timeline. In the first six months of 2021 Malaysia recorded 14 listings raising approximately RM395 million with a market capitalisation of RM15 billion.

Of the 14 listings two were main listings seven in the ACE market and five in the leap market. 1003041 Block J Jaya One No. The third way to apply for an IPO is to apply online.

We are ready to help you overcome the hurdles to becoming a public listed company on the. One copy will be returned to customer for future reference. The diagram below shows the listing process for the Main Market and ACE Market of Bursa Malaysia.

If the team in charge of the IPO is well-organized the companys initial public offering IPO will normally take six. Any material non-compliance would need to be. The conceptual timeline for the listing process is as follows-.

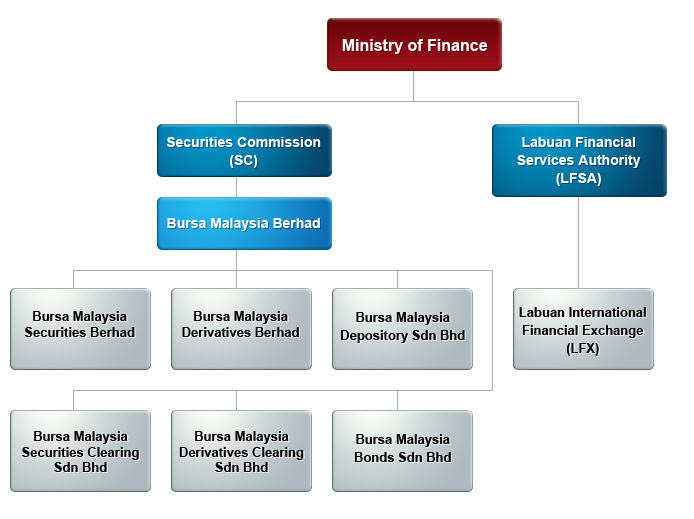

2021 has been a successful year for the IPO Market in Malaysia with numerous companies looking to list on the markets of Bursa Securities Malaysia Berhad. With hopes for an even stronger year in 2022 in this alert our associate Rowena Ng Zhi Ying from the firms Capital Markets and MA practice summarises the listing criteria for primary listing on the Main ACE. In 2020 Malaysia saw a record number of IPOs and that trend carried on to the first half of 2021.

Before starting any of the other IPO process steps a company first has to connect with a reputable underwriter or group of underwriters. Applying for an IPO from the comfort of your own home is now increasingly popular with retail investors. The following section explains the process in details.

Usually this allows it to have funds to expand and the investors could also enjoy this potential growth. For past IPOs and the latest count on the number of Listed Companies on Bursa Malaysia please click here. The initial public offering IPO process is complicated and the length of time it takes relies on a variety of factors.

As one of the top IPO leaders in Malaysia with over 20 years experience in successful IPO executions Crowe Malaysia has assisted public and private company clients in reaching their goals through audit tax advisory risk and performance services. This is Part 2 of the 6 part series in Initial Public Offering knowledge articles written by KL Management Services. When a company decides to go public it needs to hire an investment bank.

Cashlez Startup Aims For Idr 87 5 Billion Through Ipo Start Up Initial Public Offering Stock Exchange Retired Rmaf Tudm Skyhawks At Kuantan Air Base Royal Malaysian Air Force Kuantan Air. Petronas Chemical Group Berhad set its Initial Public Offering price at at RM504 a share for retail investors and managed to raise RM 128 billion. Initial Public Offering IPOs is a type a process happened when the private company issued new or existing shares to be sold to the general public in the primary market to raise funds.

An Initial Public Offering IPO allows a company to raise capital. Here is a piece of good news. The Approval Process of Main Market IPOs in Malaysia.

The payment is RM95000 per class if the list of goods or services applied for is adopted from the pre-approved list of goods. Ipo process in malaysia. Up-and-coming IPOs as well as listing statistics can be found here.

The Investment bank goes through the companys financial statements and evaluates the worth and risks. Audit Assurance and Taxation Services in Malaysia. Again these are investment banks that are registered with the SEC to offer underwriting services.

Ipo malaysia process wallpaper. Unlike the other two application routes the online application is a relatively new development. This is when due diligence is conducted on the applicant company and its group of companies.

PCG made its debut on the main market of Bursa Malaysia Securities in November 2010 and in that year it was the biggest initial public offering IPO in Malaysia and Southeast Asia. Submission sets the IPO process in motion. Step 1- Selection of an Investment Bank.

The investment bank is selected according to the following criteria. Here are the various steps involved in a listing exercise. Most of the work for IPO is done at the pre-submission stage.

Rules Making Process About Bursa Malaysia Regulatory Regulatory ApproachPhilosophy. Challenge process to ensure thoroughness and consistency in the recommendation of the application to be tabled to the Issues Committee. Here are the steps they must go through.

There is a long process before your company can start trading on the stock exchange. A patent is an exclusive right granted for an invention which is a product or a process that provides in general a new way of doing something or offers a new technical solution to a problem. The trademark size must not exceed 10 cm x 10 cm.

The capital gains from the sale of the shares will be used to buy machinery land or repay for the loansdebts of a company. By CAPITALMY 17032020 IPO Public Listing 2 Comments. Initial Public Offering IPO is where the companies are selling their shares some portion of it to the public to raise funds for the business.

The listing process from the time you engage an adviser to the day of listing will normally take four to nine months depending on the structure and complexity of the listing scheme. These banks act as market intermediary in the process of company listing. Upon approval you will be given six months to complete your IPO exercise.

In 2005 Maybank became Malaysias first bank to offer this online convenience. The principal adviser will assist you in the selection and appointment of the various relevant advisers. Most of the companies that offering.

Distribution ie if the investment bank can provide the issued securities to. 2 copies of completed application model form is available. The Issues Committee comprising different members of the Commission convenes to deliberate and decide on the IPO application.

30 IPOs in Malaysia are expected for 2021. 72A Jalan Prof Diraja Ungku Aziz. A utility innovation is an exclusive right granted for a minor invention which does not require to satisfy the test of inventiveness as required of a.

The first step in the IPO process is for the issuing company to choose an investment bank to advise the company on its IPO and to provide underwriting services.

Initial Public Offering How Do You Apply

Understanding Of Initial Public Offerings Ipos Shareinvestor Academy Malaysia

![]()

Mina Mar Group Inc Leading Investor Relations M A Raising Capital Investing Flywheel

Malaysia Ipo Tutorial Part 1 How To Apply Or Buy Ipo

All You Need To Know About Bursa Malaysia Ipo Application

Launching A Ride Sharing App In Malaysia And Singapore Regulations Tech Singapore Malaysia Singapore Malaysia

Listing Your Company On Bursa Malaysia Ipos In 2021

Ipo Advisory Services Deloitte Malaysia

Ipo Advisory Services Deloitte Malaysia

What You Need To Know Listing At Bursa Malaysia Listing And The Requirements Hills Cheryl

Netzme Application Startup Companies Are Ready To Begin The Process Of Carrying Out An Initial Public Offeri Start Up Initial Public Offering Literacy Programs

Asean Countries Swap Ico For Sto As Fraud Free Regulated Ipo Raising Capital Growth Company Securities And Exchange Commission

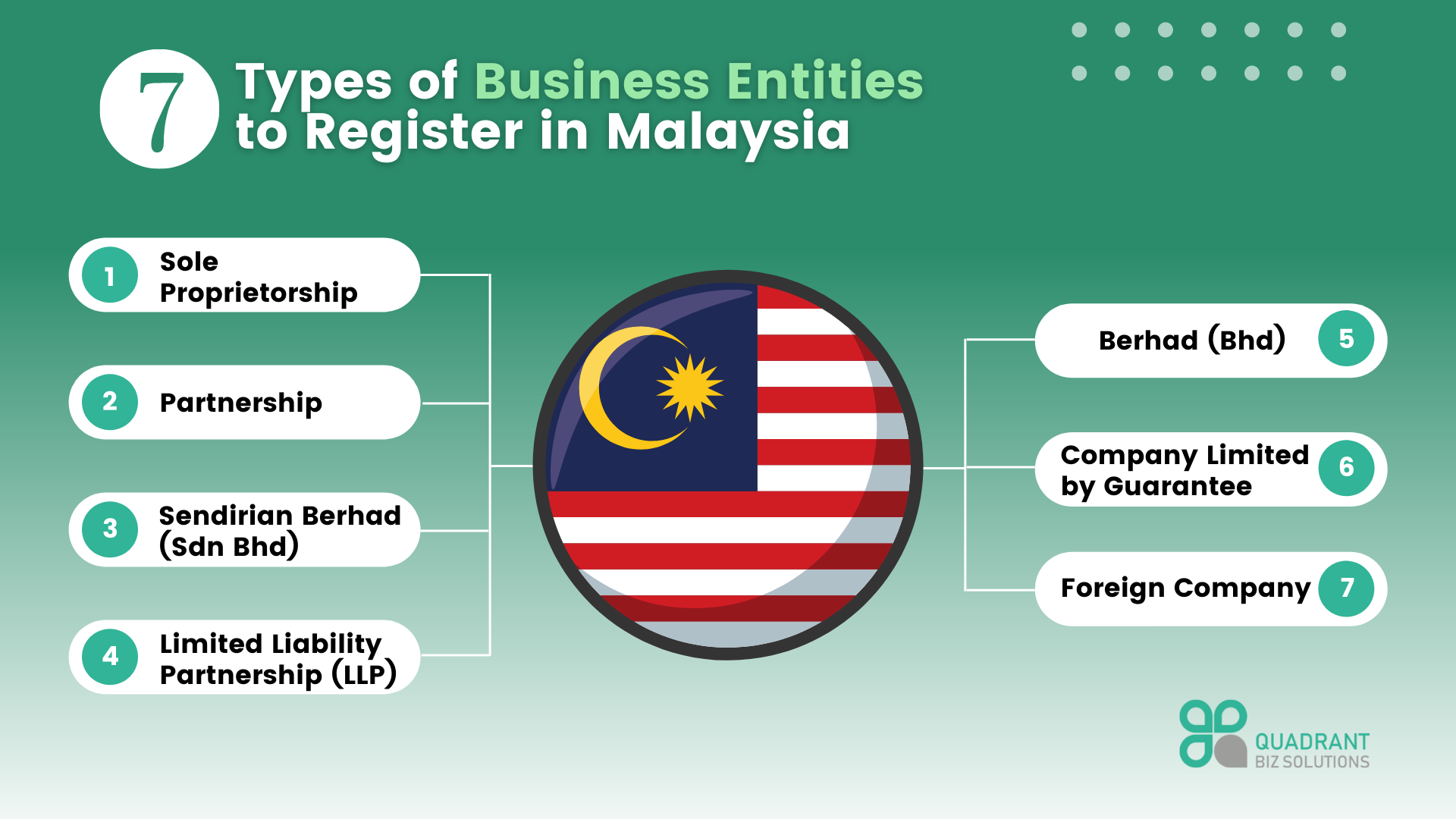

Understanding Business Entities In Malaysia Quadrant Biz Solutions